ADDRESS VERIFICATION POLICY 2.0

INTRODUCTION

This document serves as a foundational guide for ensuring the accuracy and authenticity of addresses collected and maintained within our systems. Accurate address information is crucial for effective communication, compliance with regulatory requirements, and delivering products or services to the right customers. This policy outlines the guidelines for verifying and validating the house address and employment of potential customers. By adhering to these guidelines, we aim to enhance operational efficiency and customer satisfaction while upholding the accuracy of data presented by customers.

PURPOSE AND SCOPE

The purpose of this policy document is to clearly state the optimized and acceptable processes and policies for making address verification requests, acceptable timelines, and penalty measures for non-adherence. This document was revised based on some gaps identified in the previous policy.

This document covers gaps in the current AVR policy and how the new policy seeks to bridge such gaps.

CURRENT POLICIES

The purpose of these policies is to maintain oversight over stakeholders and ensure a smooth and efficient address verification process, minimizing any potential issues or disruptions. They are to be strictly adhered to. The following policies are current measures for address verification:

1. A clear and current utility bill (NEPA Bill, water bill, waste Bill, rent receipts, and any other document showing the client’s full address) should be provided for ALL TRANSACTIONS; Address verification request should be requested for transactions with discrepancies in information (determined by the underwriter) provided by the customer. These discrepancies include but are not limited to

I. Inability to provide utility bill/ utility bill does not provide or include the required information.

II. Inability to provide proof of residency in the address.

III. Inability to provide proof of employability.

IV. Other discrepancies are based on the discretion of the Underwriter/Internal Auditor.

However, transactions below N300,000 regardless of the discrepancies noticed would not have an address verification carried out (aside otherwise approved by the Vendor Manager).

2. An office visitation is only required when the customer does not possess a work ID or an official email address.

3. Address verification will only be carried out for repeat customers if the previous visitation report is older than 6 months or the customer’s address has been changed.

4. The turn-around time for address verification is 24 hours for locations within Lagos and 48 hours outside these states (some verifications might take longer due to unforeseen circumstances).

5. Only the Vendor Manager and Lead, Underwriting Support are authorized to place calls or send emails to vendors. Every issue experienced with the vendor or the report should be escalated to either of these parties. In certain cases, the HCRM or Lead Underwriter can send an email if the issue reported is not being treated satisfactorily.

6. When a report comes in as failed, the Vendor Manager must be informed before a re-verification request is sent.

7. Credit Control and Internal Audit shall not process any transactions that require visitation without sighting an original visitation report.

8. This policy does not exclude Internal Audit from random/scheduled visits to selected clients’ addresses.

COMPLIANCE MEASURES

|

Process |

Policies |

Compliance Measures |

|

Sending of Request to the Vendor |

The Underwriting Support Officer is expected to send the verification request to the vendor within an hour of receiving the request from the Underwriter. |

TAT will be monitored and staff who exceed the stated timeframe will be penalized. |

|

The Underwriting Support Officer is expected to only send verification requests based on |

The cost of any verification request sent outside of the stipulated policies |

|

|

the policy guidelines and underwriting’s conditions. |

will be borne by the Underwriting Support Officer. |

|

Collection, Verification of the required information, and notification to the customer. |

Underwriting Support Officers and Account Officers are expected to clarify the correct addresses and other information from the customers/account officer before sending the request. See appendix for details. Account Officers should ensure that customers are duly informed of visitations by vendors. |

The Underwriting Support Officers/ Account officer will bear the cost of any incorrect report/re-verification due to the wrong information provided. |

|

Follow up in cases where the vendor exceeds TAT |

Issues like this should be escalated to the Lead, Underwriting Support who in turn informs the Vendor Manager if all efforts to resolve the issue prove abortive. |

|

|

Making re-verification requests |

The Underwriting Support Officer must seek approval from the vendor manager before proceeding to make another request. |

The cost of any request sent more than once regardless of the issue without prior knowledge of the Vendor Manager would be borne by the Underwriting Support Officer who made the request |

GAP ANALYSIS

|

S/N |

Current Process |

Purpose |

Gap Analysis |

Recommendation |

|

1 |

A clear and current utility bill (NEPA Bill, water bill, waste Bill, rent receipts, and any other document showing the client’s full address). |

To verify the applicant’s house address. |

Limited documents in the previous policy. |

If the customer is unable to provide any of the documents in the current process, they can provide one of the following for verification: land use charge, mortgage receipts, electricity meter number. The |

|

|

|

|

|

address on the provided instruments should match the address on the application form. |

|

2 |

Transactions below N300,000 regardless of the discrepancies noticed would not have an address verification carried out (asides otherwise approved by the Vendor Manager). |

To ensure house documents are provided and for cost reduction and control. |

A lot of expenses go into AVR requests. Saving money on this would be cost- effective considering that a lot of transactions are low- value. |

Transactions of N1,000,000 and below must not have a house visitation carried out. Thus, a clear and well-detailed address verification document must be provided. Transactions above N1,000,000 would compulsorily have a house visitation carried out whether or not there are discrepancies in the house address verification documents provided. |

|

3 |

An office visitation is only required when the customer does not possess a work ID or an official email address. |

This confirms that the customer is currently employed at that company. |

Limited documents in the previous policy. A work ID can be doctored and may not be easily verified. |

Office visitation is only required where a customer is unable to provide an official email address or official HR email address. Office visitation for transactions below 1 million must have the express approval of the HCRM. |

|

4 |

N/A |

N/A |

No provision for this recommendation in the current policy. This process eliminates the communication gap between the Sales and Underwriting Support teams regarding what customer has been verified. |

The Underwriting Support team is to send daily reports on address verification requests to the sales team with the business operations team in copy. This process was implemented previously but not included in the current policy. |

|

5 |

Address verification will only be carried out for repeat |

To cut costs on address |

The address verification window is |

House and office visitation will only be carried out for returning customers |

|

|

customers if the previous visitation report is older than 6 months or the customer’s address has been changed. |

verification for repeat customers. |

too soon for returning customers. |

(above 1 million) if the previous visitation report is older than 9 months or the customer’s address has changed. Note: The customer is still required to provide a utility bill and official email address/official HR email address regardless of their house address. |

RECOMMENDED POLICIES – HOUSE ADDRESS VERIFICATION

The updated policies demonstrate the identified deficiencies in the previous policy and emphasize the suggested modifications. These are the recommended policies for house address verification.

1. A clear and detailed document showing the client’s house address in full must be provided for

ALL TRANSACTIONS. Such documents include

● A current utility bill (electricity bill, water bill, waste bill).

● Land use charge (where applicable).

● Mortgage receipts (duly stamped by the mortgage bank).

● Electricity meter number.

Any document provided must have been issued in the last 3 months.

A valid identity card may be submitted to reinforce the address on the utility bill to avoid house visitation for loans of N1,000,000 and below. Such IDs may include:

• A driver’s license.

• Permanent voters’ card.

• National ID card.

• National Identification Number (NIN)/ NIN slip.

2. House visitation should only be requested for transactions within the transaction limit or documents with discrepancies or in information (as determined by the underwriter). These discrepancies may include but are not limited to:

i. Inability to provide a utility bill and other necessary documents stated above that show proof of residency at the said address.

ii. The utility bill provided does not provide or include the required information.

iii. The address on the utility bill does not match that on the application form.

iv. Other discrepancies based on the discretion of the Underwriter/Internal Auditor (where applicable), whereas if discrepancies are seen, comments should be made concerning them for reference.

3. Transactions of N1,000,000 and below should not have a house visitation carried out. Thus, a clear and well-detailed address verification document must be provided alongside additional documents (valid means of ID as documented above) to reinforce the genuineness of the address to push forward the loan except otherwise countered by the CRM team. However, if the utility bill has discrepancies, approval must be sought from the Vendor Manager before a house visitation is carried out.

4. All transactions above N1,000,000 would compulsorily have a house visitation carried out whether or not there are discrepancies in the house address verification documents provided.

5. House visitation will only be carried out for returning customers if the previous visitation report is older than 9 months or the customer’s address has changed, in which case the customer must provide a fresh utility bill. This clause follows the transaction amount provided in the clauses above.

RECOMMENDED POLICIES – EMPLOYMENT VERIFICATION

Documents to show proof of employment include:

● Official email address.

● Official Human Resources (HR) email.

The preferred mode of employment verification is by verifying the official email address of the client.

These are the recommended policies for office visitation.

1. For loans of N1,000,000 and below, no office visitation will be carried out. Such customers must provide an official email address or official HR email address for verification. If there are discrepancies with the emails provided or the client is unable to provide an official email address, an office visitation would only be carried out after express approval from the Head of the Credit Risk Department (HCRM).

2. For loans above N1,000,000, office visitation is left to the discretion of the risk management team. This means that office visitation may be required after the official email address and HR email address have been provided.

3. Office visitation will only be carried out for returning customers if the previous visitation report is older than 9 months or the customer has changed jobs and cannot provide an official email address or HR email address. The customer’s official email address must be verified for every new transaction. This clause follows the transaction amount provided in the clauses above.

EXCEPTIONS TO THE POLICY

The following exception applies to personal loans only.

| S/N | SECTOR | POLICY |

| 1. | Pensioners | 1. No employment verification of any kind. 2. House visitation to be carried out for all loans regardless of amount. |

| 2. | Teachers | 1. Office visitation is to be carried out regardless of the amount. 2. Official ID card must be provided. 3. House AVR remains according to the policy. |

| 3. | Local Government Employees | 1. Office visitation is to be carried out regardless of the amount. 2. Official ID card must be provided. 3. House AVR remains according to the policy. |

| 4. | State Civil Service Employees | 1. Office visitation is to be carried out regardless of the amount. 2. Official ID card must be provided. 3. House AVR remains according to the policy. |

| 5. | Some Federal Parastatals and Agencies | 1. Office visitation is to be carried out regardless of the amount. 2. Official ID card must be provided. 3. House AVR remains according to the policy. |

| 6. | Politically Exposed Persons (Pep) | 1. Office visitation is to be carried out regardless of the amount. 2. Official ID card may be provided. 3. House AVR remains according to the policy. |

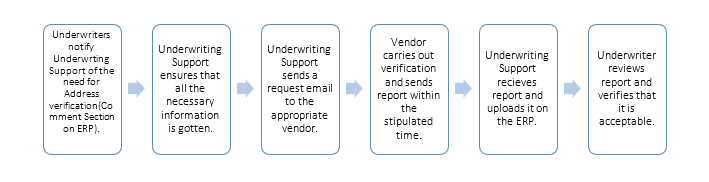

PROCESS FOR REQUESTING ADDRESS VERIFICATION REPORTS

JUSTIFICATION FOR RECOMMENDED POLICIES

The justification for the recommended AVR policies stemmed from an analysis of the AVR policies of 5 other OFIs, namely: Page Financials, Zedvance, RenMoney, Fair Money, and Credit Direct. It was discovered that house or office visitations are rarely carried out except for amounts ranging from 3 million naira. Credit Direct and Page Financials, for instance do not carry out address visitation at all and only deal with clients that can provide clearly detailed utility bills and verifiable official email addresses.

OTHER IMPORTANT GUIDELINES FOR AVR

1. All new loans (from new or returning customers) must come with documents showing proof of residence and employment verification.

2. If the CRM departments recommends that an address visitation be carried out, the Vendor Manager must give his/her approval.

3. The turn-around time for all forms of address verification (house and office) is 24 - 48 hours for locations within Lagos and 48 - 72 hours outside Lagos (some verifications might take longer due to unforeseen circumstances).

4. A customer’s (new or returning) official email address must be verified afresh for every new transaction.

5. Only the Vendor Manager, Lead Underwriting Support, Lead Underwriter and the Head of the Credit Risk Department (HCRM) are authorized to place calls or send emails to vendors for issues or escalations. Every issue experienced with the vendor or the report should be escalated to either of these parties.

6. When a report comes in as “failed”, the Vendor Manager must be informed and give approval before a re-verification request is sent.

7. Credit Control and Internal Audit teams shall not process transactions that require visitation without sighting an original visitation report (where applicable e.g., B2B transactions).

8. This policy does not exclude Internal Audit from random/scheduled visits to selected clients' addresses.

9. The Underwriting Support team is to send daily reports on address verification requests to the sales team with the business operations team in copy.

10. Any bank statement spooled must tally with the name of the client’s employer and salary filled on the application form.

11. Any visitation report that exceeds the agreed timeline will be followed up by sanctions agreed upon in the SLA (Service Level Agreement) with the defaulting vendor.

COMPLIANCE MEASURES

|

Process |

Policies |

Compliance Measures |

|

Sending of Request to the Vendor |

The Underwriting Support Officer is expected to send the verification request to the vendor within an hour of receiving the request from the Underwriter with the Vendor Manager and Business Operations in copy. |

TAT will be monitored and staff who exceeds the stated timeframe will be penalized. |

|

The Underwriting Support Officer is expected to only send verification requests based on the policy guidelines and underwriting’s conditions. |

The cost of any verification request sent outside of the stipulated policies will be borne by the Underwriting Support Officer. |

|

|

Collection, Verification of the required information and notification to the customer. |

Underwriting Support Officers and Account Officers are expected to clarify the correct addresses and other information from the customers/account officer before sending the request. See appendix for details. Account Officers should ensure that customers are duly informed of visitations by vendors. However, the date and time are not stated. |

The Underwriting Support Officers/ Account officer will bear the cost of any incorrect report/re-verification due to the wrong information provided. |

|

Follow-up in cases where the vendor exceeds TAT |

Issues like this should be escalated to the Lead, Underwriting Support who in turn informs the Vendor Manager if all efforts to resolve the issue prove abortive. |

|

|

Making re-verification requests |

The officer who requests a re-visitation must seek approval from the Vendor Manager before proceeding to make another request. The reason for the re-visitation must be stated clearly. |

The cost of any request sent more than once regardless of the issue without prior knowledge of the Vendor Manager would be borne by the officer who sent the email request to the vendor. NOTE: |

|

|

|

· Only the Vendor Manager and Lead, Underwriting Support can send visitation requests to the vendors. · Where the Vendor Manager is aware of the re-verification request, RFS will only pay once for a re-verification. Approval from the HCRM will be needed where the re-verification is required more than once. |

IN-HOUSE DISPATCHERS FOR AVR REQUESTS

In the event that a third-party AVR vendor fails to keep to the agreed timeline for AVR reports, or a verification report is needed for an address close the office premises (e.g., Yaba or Surulere for the Lagos office). Rosabon may decide to send its own dispatch riders to carry out the AVR requests. This is for AVR requests within RFS’ office states i.e., Lagos, Abuja and Rivers.

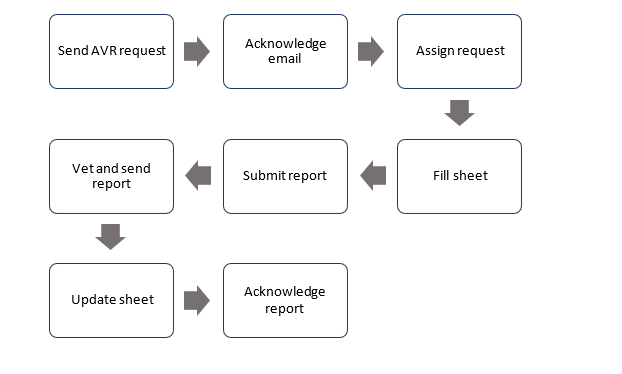

The process for allocating AVR requests is as follows:

1. The vendor manager or underwriting support team lead sends an email to the internal operations supervisor, requesting an AVR be done for a client. In the case where the email is coming from the underwriting support team, the vendor manager must be in copy of the email.

2. Internal operations supervisor acknowledges the email within a 30-minute timeline and assigns the AVR request to a dispatch rider. A rider is expected to be assigned within 1 hour of receiving the email whether or not the email is acknowledged.

3. Once assigned, the IO (internal operations) supervisor fills a Google sheet with the time the request was assigned to the rider, alongside the name of the client, the requesting party and the rider assigned. Once assigned, the rider is expected to set off to that address.

4. The rider brings back the report and the IO supervisor vets the report and sends to the requesting party. If the rider has a smartphone, he is expected to send a snapshot of the filled report to the supervisor before getting to the office.

5. The IO supervisor updates the sheet with the time the report was sent.

6. The requesting party acknowledges the receipt of the report.

In a case where the rider has to carry out multiple verifications, once he confirms the address, he places a call to the I-O supervisor who updates the address status on the sheet and confirms from the tracker on the bike that the rider reached the destination. All the reports will be sent at once when the rider gets back to the office.

PROCESS FLOW

PROCEDURAL DETAILS

|

S/N |

Action |

Process |

Responsible Party |

Timeline |

|

1 |

Send AVR request |

Requesting party send an email to internal operations, requesting an AVR be done for a client. |

Vendor Manager/Underwriting Support Lead |

As at when needed. |

|

2 |

Acknowledge email |

Supervisor acknowledges the email. |

Internal Operations supervisor |

30 mins |

|

3 |

Assign request |

Assign the AVR request to a dispatch rider. |

Internal Operations supervisor |

1 hour from when email is sent |

|

4 |

Fill sheet |

Fill a Google sheet with the time the request was assigned to the rider. |

Internal Operations supervisor |

1 min |

|

5 |

Submit report |

The rider submits the AVR report to the supervisor. |

Dispatch rider |

1 min |

|

6 |

Vet and send report |

Vet the report and send to the requesting party via email |

Internal Operations supervisor |

10 mins |

|

7 |

Update sheet |

Update the sheet with the time the report was sent. |

Internal Operations supervisor |

1 min |

|

8 |

Acknowledge report |

Requesting party acknowledges the receipt of the report via email. |

Requesting Party (Vendor Manager/Underwriting Support Lead) |

30 mins |

IMPORTANT NOTES:

• The vendor manager, business operations team and internal operations team must always be in copy of all emails concerning dispatch AVR requests.

• The TAT for AVR is 6 hours from when the time the rider was assigned till the report is sent. This will be evident on the Google sheet.

• IO supervisor is required to confirm the dispatch rider’s location via the motorcycle tracker at regular intervals, to ensure rider’s integrity.

• The IO supervisor will create the sheet and grant view access to the vendor manager, underwriting support team lead and business operations team.

If the timeline for an AVR report from external vendors is elapsed, an email must be sent to the vendor asking that the request be cancelled before it is assigned to the internal dispatch rider.

COMPLIANCE MEASURES

|

Process |

Policies |

Compliance Measures |

|

Sending of Request to Internal Operations |

The Lead Underwriting Support or/and Vendor Manager are to send the verification request to internal operations when a verification in our major office regions have passes the TAT, or an address to be verified is within the vicinity of our major offices, with Business Operations in copy. |

TAT will be monitored and staff who exceeds the stated timeframe will be cautioned. |

|

Collection, Verification of the required information and notification to the customer. |

Underwriting Support Officers and Account Officers are expected to clarify the correct addresses and other information from the customers/account officer before sending the request. See appendix for details. Account Officers should ensure that customers are duly informed of visitations by vendors. However, the date and time are not stated. |

The Underwriting Support Officers/ Account officer will bear the cost of any incorrect report/re-verification due to the wrong information provided. |

|

Follow-up in cases where I-O exceeds TAT |

Issues like this should be escalated to the Lead, Underwriting Support who in turn informs the Vendor Manager if all efforts to resolve the issue prove abortive. |

IO must give reasons as to why the Verification process has taken too long. |

|

Making re-verification requests |

If an address being verified by I-O comes out unsuccessful, no reverification for that client will be done. |

Stakeholders involved (CRM, Sales) should give valid reasons as to why a revisitation request will be carried out. |

VERSION HISTORY

|

Version |

Revision Date |

Description of Change |

Author |

Stakeholders’ Concurrence |

|

1.0 |

11/12/23 |

First draft |

Obiageli Mbah |

Chima Annonye Fisayo Ariyo Anthonia Ogbu Collins Jatto Abdullahi Boladale Ayodele Kappo Emmanuel Onakoya |

|

|

|

|

|

|

|

|

|

|

|

|

APPENDIX A

HOUSE VERIFICATION REPORT FORMAT

|

S/N |

Enquiry |

Status |

|

1 |

Client name |

|

|

2 |

House address |

|

|

3 |

Nearest landmark or bus stop |

|

|

4 |

Local government where the address is located |

|

|

5 |

Does the client reside at the said address? |

|

|

6 |

Color of the building |

|

|

7 |

Building description (bungalow, one storey, gated, fenced, roof color, etc) |

|

|

8 |

Name of neighbor that confirmed the address (preferably the landlord or caretaker) |

|

|

9 |

Name of verification officer |

|

|

10 |

Date of visit |

|

|

11 |

General remarks |

|

|

12 |

Verification officer’s signature |

|

APPENDIX B

OFFICE VISITATION REPORT FORMAT

|

S/N |

Enquiry |

Status |

|

1 |

Name of employee |

|

|

2 |

Name of organization |

|

|

3 |

Office address |

|

|

4 |

Nearest landmark/bus stop |

|

|

5 |

Colour of the building |

|

|

6 |

Employment status |

|

|

7 |

Department |

|

|

8 |

Role title |

|

|

9 |

Name of staff that provided the information (preferably in the HR or clients experience/customer service/reception) |

|

|

10 |

Name of verification officer |

|

|

11 |

Date of visit |

|

|

12 |

General remarks |

|

|

13 |

Verification officer’s signature |

|

No Comments