Brokers Admin SOP Doc

BROKERS ADMIN (RFS)

STANDARD OPERATING PROCEDURE

Table of Contents

1. COVER PAGE

2. TABLE OF CONTENT

3. INTRODUCTION

4. OBJECTIVES & PURPOSE

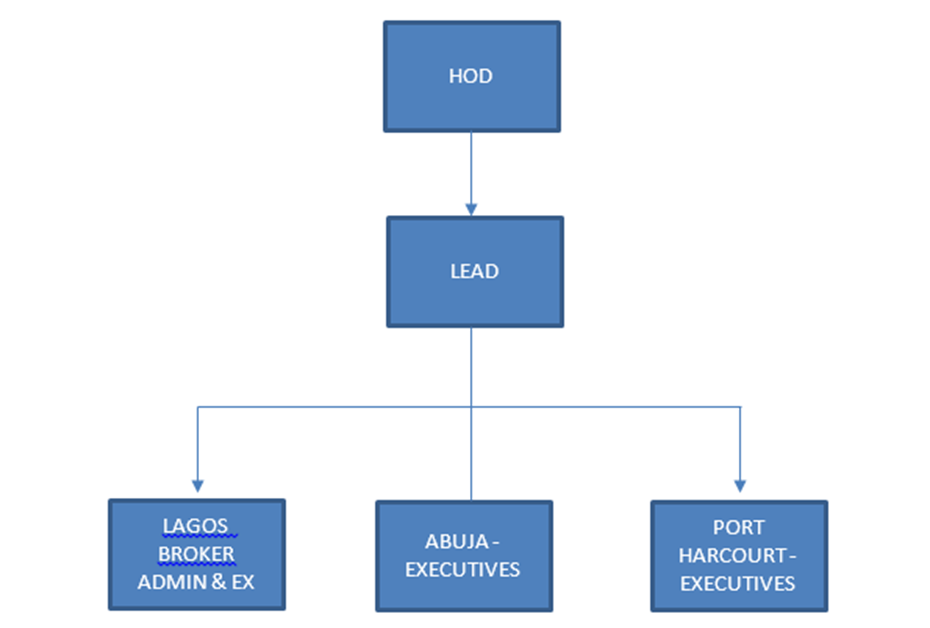

5. ORGANOGRAM

6. LIST OF ACTIVITIES/ JOBS IN THE DEPARTMENT

7. PROCEDURE FOR EACH OF THE ABOVE LISTED ACTIVITIES

8. REVIEWED TIMELINE

9. APPROVAL PAGE

1.0 INTRODUCTION

Rosabon Financial Services (RFS) is an award-winning member of the Concept Group licensed by the Central Bank of Nigeria, CBN on April 22, 1993 to provide loans, leases and investments to eligible individuals, SME businesses and Corporate Organizations (medium and Large). A long standing member of the Equipment Leasing Association of Nigeria (ELAN), we have evolved into Nigeria's leading Non-Bank Financial Intermediary and Equipment Leasing firm focused on niche and general markets.

Our work draws on over 30 years of experience in the field of finance advisory and management, tailoring our lease, loans and investment offerings to meet the financial needs of our customers either on a long or short term. We recognize that we can only be successful when the eligible individuals, businesses and Corporate Organizations we serve are able to reach their vision of success. We have a long-term commitment to helping communities thrive and prosper-both economically and socially – with our operations located across several States in Nigeria. Over the years, we have received awards (Local and International) for our outstanding work in the Financial Services industry. Our success is attributed to our emphasis on customer satisfaction, integrity, professionalism and our utmost commitment to excellence. With our headquarters located in Yaba, Lagos, Rosabon Financial Services was founded in 1993.

The Brokers unit is responsible for developing, managing, sourcing, maintaining relationships with brokers and their various leads, communicating broker’s satisfaction level with regards to Concept Nova and Rosabon’s offerings, handling complaint and enquires, content creation, bringing new ideas to move the portal and the concept group forward in terms of brokers strength, sales generated and the engagement of brokers on the portal.

The unit work using Customer service and Marketing function to nurture leads through the sales funnel, from the addition of leads on the portal down through purchase (and repeat purchases). Brokers’ admins use various methods to reach brokers, including email, phone, social media, direct mail, and even the old fashioned door-to-door tactic. Brokers’ admin manages supports and communicates with brokers to ensure lead generation.

They are expected to analyze brokers’ feedbacks and report to the Managing director/ Marketing and Strategy team to aid managerial and strategic decision making.

This SOP was designed to establish guidelines for the Broker's Administration department. (Rosabon Financial Services).

This process aims to ensure that everyone in the department is well-informed of their duties and responsibilities. It is also going to serve as a guide to ensure excellent service at all times and to avoid delays and lags in the process of dealing with all RFS brokers and clients.

2.0 OBJECTIVES & PURPOSE

This SOP details the structure, roles, functions, step-by-step process to be taken by all Broker's Administration Executives from the moment a prospective or existing broker/client makes contact with RFS through any of the communication channels and the policies related to the unit.

This document covers the process of responding to enquiries, determining eligibility for loan packages,

transferring leads to appropriate departments, follow-up on leads, engaging brokers/customers after account consummations, up until the end of the transaction life-cycle and engagement afterwards.

3.0 ORGANOGRAM

The structure below is subject to change as the need arises.

4.0 LIST OF ACTIVITIES/ JOBS IN THE DEPARTMENT

LEAD

FUNCTIONS

· The Supervisor oversees the effective engagement of clients/ brokers by all executives and Admins and makes sure all complaints are effectively managed or escalated to the appropriate department as well as gives feedback to management for effective decision-making.

a. To generate sales as stated in the set departmental and personal targets

b. To maintain high satisfaction levels when managing Prospects and Clients through the booking of transactions

c. Coordinate department’s role in the marketing of products via flyer distribution, assistance at events, etc.

d. Reports to Management

e. Supervises team members regrading new leads and opportunities, client acquisition and customer retention, client engagement and cross selling of all products and services.

f. Works with Head, Strategy & Marketing by:

i. Contributing to the development of new products and programs

ii. Providing sales feedback

iii. Exploiting marketing campaigns

g. Works with Branch Managers at the different locations to manage department performance in the respective branches by:

i. Coordinating sales efforts in line with marketing strategies

ii. Providing guidance to department’s team members

h. Works with Head, Internal Control to ensure that established operating protocols are respected especially as regards brokerages. The Supervisor collates and vets brokerages sent by executives from different locations, then send them to the various stakeholders for onward approval and payment.

i. Works with Head, Client Services to have Clients confirm that they have received high-quality service throughout:

i. The booking process

ii. The handling of incidents as they occur

j. Works with Head, Accounts & Finance to:

i. Disburse funds promptly after final approval of transactions

ii. Manage payments made by Clients and communicate accordingly

k. Works with Head, Administration to manage logistics

i. Works with Head, Human Resources to Recruit staff

ii. Administer relevant HR processes for the department.

L. Works with Head, Training to improve the knowledge, skills and attitudes of department members

·

SALES EXECUTIVE

FUNCTION OF BROKERS SALES EXECUTIVE (SUMMARY)

· The Brokers sales executive unit is responsible for developing, managing, sourcing, and maintaining relationships with brokers and their various leads, communicating broker’s satisfaction level with regards to Rosabon offerings, handling complaints and enquires, content creation, bringing new ideas to move the department and the concept group forward in terms of brokers strength and successful consummation of sales generated.

· The Brokers Sales executive works using Customer service and Marketing functions to nurture leads through the sales funnel, from the addition of leads on the portal down through purchase (and repeat purchases). Brokers’ sales executives use various methods to reach clients, including email, phone, social media, direct mail, and even the old-fashioned door-to-door tactic. Brokers’ sales executive manages supports and communicates with clients to ensure all leads are effectively managed and their transactions are successfully consummated.

· They are expected to follow up solely with all leads transferred to them, work on all the stages following the set policy and procedures and ensure all transactions are successfully consummated. They communicate all issues encountered during the processing stage and feedback from clients to the Head Brokers' admin for a swift resolution.

Broker’s Admin Sales Executive (Rosabon)

The Rosabon brokers’ sales executive tends to manage all leads passed to him/her for effective follow-up, they ensure that leads are properly managed and successfully consummated. They focus on both business-to-business (B2B) and business-to-customer (B2C) transactions as well as wealth management leads and ensures all transactions passed are managed on the lead generation sheet. They support and communicate with brokers to ensure lead generation when the need arises. The risk asset leads would be passed to the risk sales executives while he/she would close the wealth management leads.

He/she is expected to analyze clients’ feedback and report to the Unit head to aid managerial and strategic decision-making.

Job Description Breakdown

· Acquisition and retention of brokers and clients through offline marketing.

· Aggressively following up with all leads referred by brokers and ensuring successful closures of all leads.

· Handles B2B and B2C leads assigned, following all set procedures and policies and ensuring the transaction is successfully consummated.

· Handle client’s enquiries via phone calls, emails, live chats and social media channels.

· Resolve clients' issues/problems by clarifying the clients' complaints; determine the cause of the problem; select and explain the best solution to solve the problem; accelerate correction or adjustment; follow up to ensure resolution.

· Acquisition of brokers through referral methods from both existing and potential clients.

· Effectively cross-market Rosabon’s products to existing and potential clients when the need arises.

· Sourcing for optimal leads that can refer customers to do business with us.

· Identify and assess the client's needs to achieve satisfaction

· Managing, supporting and communicating clients’ satisfaction levels with regards to Rosabon financial services Brokers Products.

· Engage clients at the beginning of their subscription; ensure successful take-up and management of all incidents throughout their transaction phase from which there might be a risk of dissatisfaction.

· Communicate detailed reports on clients’ requests and feedback to aid strategic and management decisions.

· Sending status and summary reports of the broker’s admin for updates on the broker’s portal on a weekly basis.

· Sending status and summary reports to the head broker’s admin on a weekly basis.

N: B: A probation period of 3 months is given, during the probation period, the brokers' sales executive is expected to have closed transactions worth N50M (this is across all Rosabon products), this will be a judging factor of his/her length of stay in the department.

ROSABON BROKER’S ADMIN JOB FUNCTION

- Manages the brokers portal Daily engagement of all brokers across all channels of communication

- Strategically recruit brokers Manages existing customers and get referrals which is to be passed to the sales executive Reduce client churned rate

- Prepare weekly sales activity report Attend to customers enquiry

· Acquisition and retention of brokers and clients through offline marketing.

· Aggressively following up with all leads referred by brokers and ensuring successful closures of all leads.

· Handles B2B and B2C leads assigned, following all set procedures and policies and ensuring the transaction is successfully consummated.

o Handle client applications via phone calls, emails, live chats and social media channels.

o Resolve clients' issues/problems by clarifying the clients' complaints; determine the cause of the problem; select and explain the best solution to solve the problem; accelerate correction or adjustment; follow up to ensure resolution and continuous referral.

o Acquisition of brokers through referral methods from both existing and potential clients.

o Effectively cross-market Rosabon’s products to existing and potential clients when the need arises.

o Sourcing for optimal leads that can refer customers to do business with us.

o Identify and assess the client's needs to achieve satisfaction

o Managing, supporting and communicating clients’ satisfaction levels with regard to Rosabon financial services products.

o Engage clients at the beginning of their subscription; ensure successful take-up and management of all incidents throughout their transaction phase from which there might be a risk of dissatisfaction.

o Communicate detailed reports on clients’ requests and feedback to aid strategic and management decisions.

o Sending status and summary reports to the broker’s admin executive for updates of the broker’s portal on a weekly basis.

PROCEDURE FOR HANDLING LEADS

· Leads generated are filled on the lead generation sheet for follow-up and subsequently passed to the department to treat the lead.

· Once a lead is p a s s e d to the Asset creation team or in the Liability generation space, details are filled transaction tracker sheet and updated as the transaction proceeds so as

to keep tabs on the stages of the transaction.

·

Once a lead is passed have been consummated by the Asset creation team or in the Liability generation space, clients' and brokers' details are filled on the Brokers sales executive consummated lead sheet

In cases where the Leads could not be consummated, the issues and the actions to be taken is filled on the incident log sheet.

· After consummation a broker admins staff calls the client 24 hours after to engage and appreciate the client for choosing us and get feedback on the client/broker’s experience so far.

· Transactions Pending each week are recorded on the weekly pending Leads sheet

· The broker’s activity sheet is used to keep a track record of the broker’s progress and how active they are

· When potential brokers indicate interest in the program their names and contact are moved to this sheet for further qualification.

· The Treasury Customer Engagement sheet is shared with the client experience team to also get customers' feedback on our services as well thanking them for choosing to invest with us send them emails and SMS on their special days as a form of customer relationship management in addition to the call they would get from the brokers' admin executives.

BROKERAGE PAYABLE TO BROKERS FOR RISK ASSET AND LIABILITY GENERATION PRODUCTS.

ROSABON TREASURY NOTE

|

CATEGORY |

AMOUNT |

TENOR |

BROKERAGE |

|

Category 1 |

N250,000 - N49,999,999 |

60 to 365 days |

1.00% |

|

Category 2 |

N50,000,000 – N99,999,999 |

60 to 365 days |

1.10% |

|

Category 3 |

N100,000,000 – N149,999,999 |

60 to 365 days |

1.30% |

|

Category 4 |

N150,000,000 – Above |

60 to 365 days |

1.50% |

Note:

· Treasury product brokerage will be split into two payment (65% will be paid once the

funds are received) and (35% will be paid at maturity).

· Brokerage on ROLL OVER FUNDS will be 1% flat irrespective of the amount.

· Brokers who are able to negotiate a lower interest rate to the client, the differential will be shared between the broker and the client. Below is the applicable sharing ratio:

Sharing formula for interest differentials (Rosabon Treasury Note).

|

TENOR |

COMPANY |

BROKER |

|

90 Days |

70% |

30% |

|

120-180 Days |

60% |

40% |

|

365 Days |

50% |

50% |

Note: The differential is paid to the broker alongside his brokerage within a week.

ROSABON Earning Product (REAP).

The compensation is based on the referred REAP account cumulative amount successfully closed.

OPTION 1: PAYMENT OF BROKERAGE AT THE END OF THE TENOR

|

CATEGORY |

REAP ACB |

% BROKERAGE (P.A) |

%ADDITIONAL BROKERAGE (P.A) (Direct debit) |

|

Category 1 |

0 – 1.99m |

1.00% |

0.5% |

|

Category 2 |

2m – 9.99m |

1.25% |

0.5% |

|

Category 3 |

10m – 14.99m |

1.50% |

0.5% |

|

Category 4 |

15m – 19.99m |

1.75% |

0.5% |

|

Category 5 |

20m & Above |

2.00% |

0.5% |

Note:

· Full (100%) brokerage will be paid for brokers that prefer to wait till the end of the tenor before receiving their brokerage.

· Brokers will get an additional 0.5% if their client chose the direct debit option.

· Any termination before the end of the set tenor will attract 50% pre-termination for brokers that wait till the end of the tenor before receiving their brokerage.

OPTION 2: PAYMENT OF BROKERAGE MONTHLY

|

CATEGORY |

REAP ACB |

% BROKERAGE (P.A) |

% PAYABLE MONTHLY |

%ADDITIONAL BROKERAGE (P.A) (Direct debit) |

|

Category 1 |

0 – 1.99m |

1.00% |

1/12 of 1.00% |

0.5% |

|

Category 2 |

2m – 9.99m |

1.25% |

1/12 of 1.25% |

0.5% |

|

Category 3 |

10m – 14.99m |

1.50% |

1/12 of 1.50% |

0.5% |

|

Category 4 |

15m – 19.99m |

1.75% |

1/12 of 1.75% |

0.5% |

|

Category 5 |

20m & Above |

2.00% |

1/12 of 2.00% |

0.5% |

|

|

|

|

|

|

Note:

· Brokerage will be paid to brokers on a monthly basis. This will be 1/12 of the brokerage fee for the set category.

· Brokers will get an additional 0.5% if their client chose the direct debit option. This will be 1/12 of the direct debit bonus for brokers that want their brokerage to be paid monthly.

COMPENSATION FOR ASSET CREATION PRODUCTS.

(LOANS AND LEASES)

Rosabon Consumer and Corporate Lease.

|

LEASE TENOR |

BROKERAGE |

MODE OF PAYMENT |

|

1 to 12 months |

1.50% |

One off payment. |

|

13 to 24 months |

1.75% |

One off payment. |

|

Above 24 months |

2.00 |

One off payment. |

Rosabon Consumer and Corporate Collateralized Loan.

|

ACL TENOR |

BROKERAGE |

MODE OF PAYMENT |

|

1 to 12 months |

1.50% |

One off payment. |

|

13 to 24 months |

2.00% |

One off payment. |

Rosabon Consumer and Corporate Uncollateralized Loan (Lesser Tenor)

|

LOAN TENOR (3-6 months) |

CATEGORIES |

BROKERAGE |

MODE OF PAYMENT |

|

|

100,000 – 1,999,999 |

1.250%

|

One off payment |

|

|

2,000,000 – 3,999,999 |

1.50% |

One off payment |

|

|

4,000,000 – 6,000,000 |

1.75% |

One off payment |

Rosabon Consumer and Corporate Uncollateralized Loan (Higher Tenor)

|

LOAN TENOR (7-15 months) |

CATEGORIES |

BROKERAGE |

MODE OF PAYMENT |

|

|

100,000 – 1,999,999 |

1.50%

|

One off payment |

|

|

2,000,000 – 3,999,999 |

1.75% |

One off payment |

|

|

4,000,000 – 6,000,000 |

2.00% |

One off payment |

Note:

ü The entire amount requested for by referred successful leads will be summed up, and the % payable for commission for the set category will be paid. The Commission is one off payment.

COMPENSATION FOR OPERATING LEASE.

|

TENOR

|

CATEGORIES |

BROKERAGE |

MODE OF PAYMENT |

|

1 year to 2 years |

0 – 500,000,000 |

0.45%

|

One off payment |

|

2 years to 3 years |

0 – 500,000,000 |

1.00% |

One off payment |

|

Above 3 years |

0 – 500,000,000 |

1.25% |

One off payment |

|

TENOR

|

CATEGORIES |

BROKERAGE |

MODE OF PAYMENT |

|

1 year to 2 years |

Above 500,000,000 |

1.00%

|

One off payment |

|

2 years to 3 years |

Above 500,000,000 |

1.25% |

One off payment |

|

Above 3 years |

Above 500,000,000 |

1.50% |

One off payment |

Note:

ü For every extension made by operating lease client, the broker get 0.25% brokerage irrespective of the tenor.

6.0 REVIEWED TIMELINE

It is recommended that this document be reviewed yearly or every 2 years or as the need arises.

APPENDIX

APPENDIX

PREQUALIFICATION QUESTIONS FOR LOAN FACILITIES

SALARY EARNER (PERSONAL LOANS)

BROKER ADMIN: Good morning, my name is …… from Rosabon Financial services, I’m calling to review the loan enquiry you made on our website. Am I unto (clients name)?

CUSTOMER: Yes, proceed.

BROKER ADMIN: Are you a salary earner or business owner?

CUSTOMER: Salary earner

BROKER ADMIN: How long have you worked with (company name)

CUSTOMER: If less than 6 months, disqualify

6 months and above: proceed

BROKER ADMIN: Were you given an employment letter when you started work at XYZ company?

CUSTOMER. If No, ask if he can request a letter from employer (if response is ‘no’ disqualify)

If yes proceed

BROKER ADMIN: Kindly confirm how much you earn monthly after taxes have been deducted.

CUSTOMER: <30k, disqualify.

>30k Proceed.

BROKER ADMIN: is your salary paid into an account?

CUSTOMER: if no, disqualify, if yes: proceed.

BROKER ADMIN: are you currently servicing a loan?

CUSTOMER: If no, proceed.

If yes, ask monthly repayments and verify in DTI if customer can access further facilities or interested in buy over. Disqualify if DTI is high, client does not want buy over.

BROKER ADMIN: How much are you applying for?

CUSTOMER: response from customer to be checked in DTI, if within acceptable range, proceed.

If above range, advise client on how much can be processed for his income range, if client accepts amount, proceed.

BROKER ADMIN: Thank you for your time, we will be sending you a link to a questionnaire titled central test. Kindly look out for the mail and respond to it so an account officer can be assigned to process your facility. Have a nice day ahead.

N.B: before contacting clients, verify that employer is not a Federal Government worker or on Rosabon’s Blacklist. In the event, the client’s employer is blacklisted, disqualify and communicate that we will not be treating request at that time.

Registered Business Owner

BROKER ADMIN: Good morning, my name is …… from Rosabon Financial services, I’m calling to review the loan enquiry you made on our website. Am I unto (clients name)?

CUSTOMER: Yes, proceed.

BROKER ADMIN: Are you a salary earner or business owner?

CUSTOMER: Business owner

BROKER ADMIN: What type of business are you into?

CUSTOMER: (refer to RFS approved business areas) If client’s response falls under excluded businesses e.g Agriculture, forex, cryptocurrency, disqualify.

If eligible business areas, proceed.

BROKER ADMIN: is your business registered with the corporate affairs?

CUSTOMER: Registered-

BROKER ADMIN: what year was the registration done?

CUSTOMER: < 1 year. Disqualify

>1 year, proceed.

BROKER ADMIN: Do you have a corporate account that has been operated for at least 12 months??

If no, Disqualify

< 1 year. Disqualify

>1 year, proceed.

BROKER ADMIN: you will be required to provide a security for the loan. Guarantor or collateral. Kindly indicate which one you will be providing.

CUSTOMER: Guarantor that meets criteria; proceed. Eligible collateral in Lagos, PH or Abuja: Proceed

If none can be provided: disqualify.

BROKER ADMIN: Thank you for your time, we will be sending you a link to a questionnaire titled central test. Kindly look out for the mail and respond to it so an account officer can be assigned to process your facility. Have a nice day ahead.

Unregistered Business Owner

BROKER ADMIN: Good morning, my name is …… from Rosabon Financial services, I’m calling to review the loan enquiry you made on our website. Am I unto (clients name)?

CUSTOMER: Yes, proceed.

BROKER ADMIN: Are you a salary earner or business owner?

CUSTOMER: Business owner

BROKER ADMIN: What type of business are you into?

CUSTOMER: (refer to RFS approved business areas) If client’s response falls under excluded businesses e.g. Agriculture, forex, cryptocurrency, disqualify.

If eligible business areas, proceed.

BROKER ADMIN: is your business registered with the corporate affairs?

C: unregistered-

BROKER ADMIN: How long have you been in operation?

CUSTOMER: < 1 year. Disqualify

>1 year, proceed.

BROKER ADMIN: Do you have a business account that has been operated for at least 12 months??

If no, Disqualify

< 1 year. Disqualify

>1 year, proceed.

BROKER ADMIN: You will be required to provide a security for the loan. Guarantor or collateral. Kindly indicate which one you will be providing.

CUSTOMER: Guarantor that meets criteria; proceed. Eligible collateral in Lagos, PH or Abuja: Proceed

If none can be provided: disqualify.

BROKER ADMIN: Thank you for your time, we will be sending you a link to a questionnaire titled central test. Kindly look out for the mail and respond to it so an account officer can be assigned to process your facility. Have a nice day ahead.

APPROVAL

APPROVAL PAGE

No Comments