Brokers Admin SOP Doc

BROKERS ADMIN (RFS)

STANDARD OPERATING PROCEDURE

Table of Contents

1. COVER PAGE

2. TABLE OF CONTENT

3. INTRODUCTION

4. OBJECTIVES & PURPOSE

5. ORGANOGRAM

6. LIST OF ACTIVITIES/ JOBS IN THE DEPARTMENT

7. PROCEDURE FOR EACH OF THE ABOVE LISTED ACTIVITIES

8. REVIEWED TIMELINE

9. APPROVAL PAGE

1.0 INTRODUCTION

This SOP was designed to establish guidelines for Brokers department. (Rosabon FinancialServices).

This process aims to ensure that everyone in the Brokers department are optimally utilized and well

informed of their duties and responsibilities.

It is also going to serve as a guide to ensure excellent service at all times and to avoid delays and lags in

the process of dealing with all RFS brokers and clients.

2.0 OBJECTIVES & PURPOSE

This SOP details the step-by-step process to be taken by all Broker Admin Executives from the moment a

prospective or existing broker/client makes contact with RFS through any of the communication channels.

This document covers the process of responding to enquiries, determining eligibility for loan packages,

transferring leads to appropriate departments, follow-up on leads, engaging brokers / customers after

account consummations, up until end of transaction life-cycle and engagement afterwards.

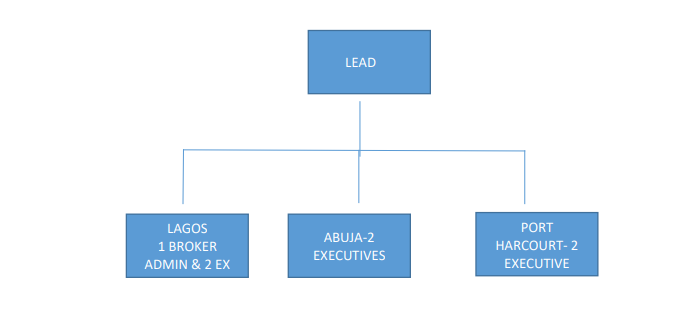

3.0 ORGANOGRAM

The structure below is subject to change as the need arises.

4.0 LIST OF ACTIVITIES/ JOBS IN THE DEPARTMENT

Effective Cross marketing of all products: Effectively cross market Rosabon’s products to existing and

potential clients when the need arises

Acquisition and Retention of Brokers: Frequent follow up on all active brokers for more brokers referral

and leads referrals. Routine offline marketing to source for optimal brokers when the need arises

Retention of clients for further business: Good relationship management of all clients to ascertain their

satisfactory level and willingness to refer other clients to do business with us.

Successful Conversion of B2C leads: Immediate follow up with all referred leads (B2C) to ensure payment

is made and installation done at the earliest time. Transfer B2B client to sales executive for proper followup.

Brokers satisfaction Improvement: Weekly follow up on all brokers to keep them abreast of the brokerage

program and ensure their need/request are being attended to

Handling of Brokers/clients enquiries: Daily handling of client’s and brokers enquiries via phone calls,

emails, live chats and social media channels. Responses must be made in 24 Hours or less.

Incident resolution: Identify issues, complaints, and proffering possible solutions to meet client’s needs.

Issues should be resolved or escalated in 48 hours or less.

Submission of weekly report: Communicate detailed reports on client’s requests and feedback to aid

strategic and management decisions. Reports must be submitted on the last work day of every week

before 2.00pm

5.0 PROCEDURE FOR EACH OF THE ABOVE LISTED ACTIVITIES

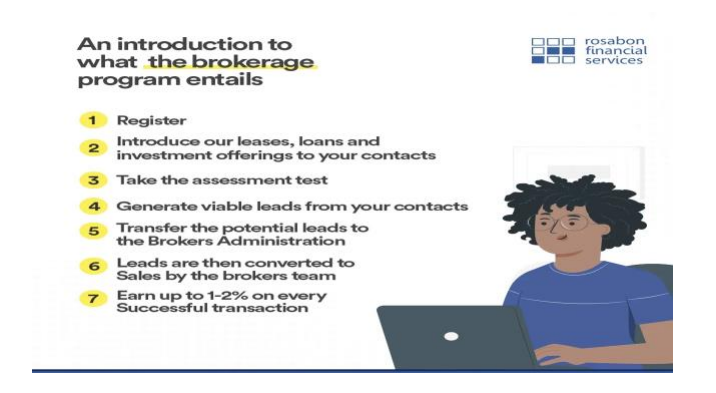

When potential brokers come on board are introduced to the program with the following steps;

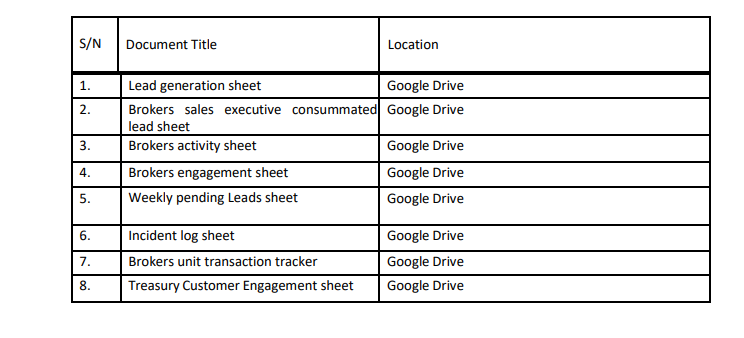

● Leads generated are filled on the lead generation sheet for follow up and subsequently

passed to the department to treat the lead.

● Once a lead is p a s s e d to the Asset creation team or in the Liability generation space,

details are filled transaction tracker sheet and updated as the transaction proceeds so as

to keep tabs with stages of the transaction.

● Once a lead i s p a s s e d have been consummated by the Asset creation team or in the

Liability generation space, clients and brokers details are filled on the Brokers sales

executive consummated lead sheet

● In cases where the Leads could not be consummated, the issues and the actions to be

taken is filled on the incident log sheet.

● After consummation a broker admins staff calls client 24 hours after to engage and

appreciate the client forchoosing us and get feedback on client / broker’s experience so

far.

● Transactions Pending each week are recorded on the weekly pending Leads sheet

● The broker’s activity sheet is used to keep a track record of broker’s progress and how

active they are

● When potential brokers indicates interest in the program their names and contact are

move to this sheet for further qualification.

● The Treasury Customer Engagement sheet is shared with client experience team to also get

customers feedback on our services as well thanking them for choosing to invest with us

send them mails and SMS on their special days as a form of customer relationship

management in addition to the call they would get from the brokers admin executives.

● The Supervisor oversees effective engagement of clients/ brokers by all executives and

makes sure all complaints are effectively managed or escalated to the appropriate

department as well as give feedback to management for effective decision making.

● The Supervisor collates and vets brokerages sent by executives from the different

locations, then send to the various stake holders for onward approval and payment.

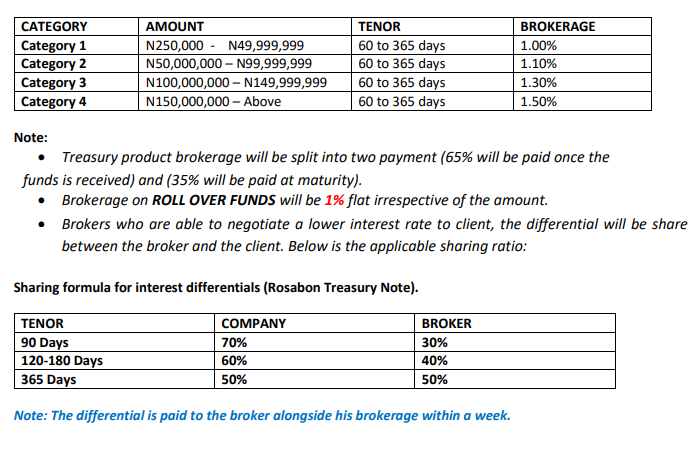

6.0 BROKERAGE PAYMENT POLICY

BROKERAGE PAYABLE TO BROKERS FOR RISK ASSET AND LIABILITY GENERATION PRODUCTS.

ROSABON TREASURY NOTE

CATEGORY AMOUNT TENOR BROKERAGE

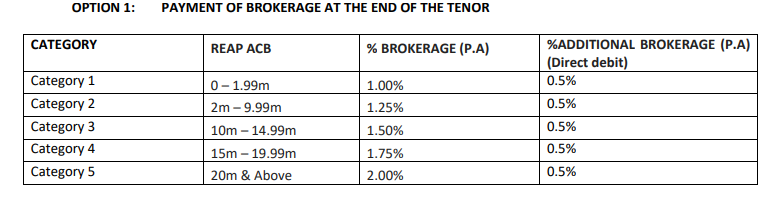

ROSABON Earning Product (REAP).

The compensation is based on the referred REAP account cumulative amount successfully closed.

Note:

Full (100%) brokerage will be paid for brokers that prefers to wait till end of the tenor before

receiving their brokerage.

Brokers will get additional 0.5% if their client chose direct debit option.

Any termination before the end of the set tenor will attract 50% pre-termination for brokers that

wait till end of the tenor before receiving their brokerage.

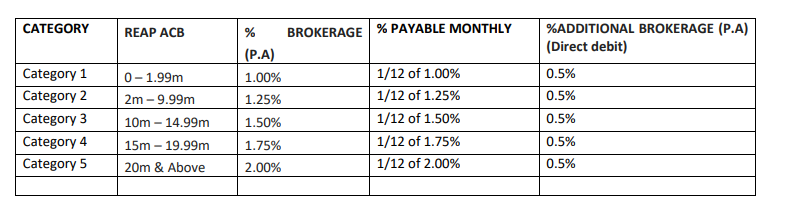

OPTION 2: PAYMENT OF BROKERAGE MONTHLY

Note:

Brokerage will be paid to brokers on a monthly basis. This will be 1/12 of the brokerage fee for the

set category.

Brokers will get additional 0.5% if their client chose direct debit option. This will be 1/12 of direct

debit bonus for brokers that want their brokerage to be paid monthly.

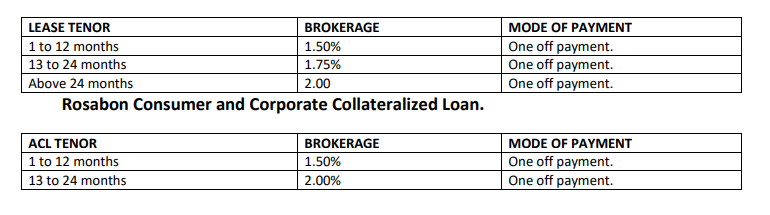

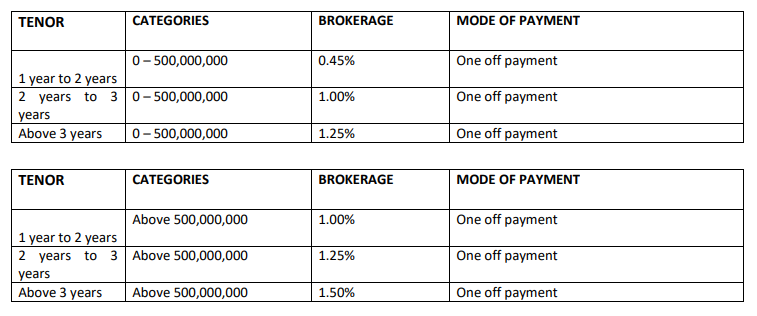

COMPENSATION FOR ASSET CREATION PRODUCTS.

Rosabon Consumer and Corporate Lease.

LEASE TENOR BROKERAGE MODE OF PAYMENT

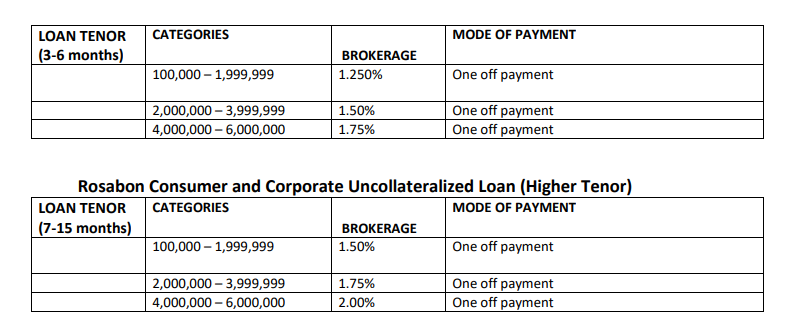

Rosabon Consumer and Corporate Uncollateralized Loan (Lesser Tenor)

Note:

The entire amount requested for by referred successful leads will be summed up, and the %

payable for commission for the set category will be paid. The Commission is one off payment.

COMPENSATION FOR OPERATING LEASE.

Note:

For every extension made by operating lease client, the broker get 0.25% brokerage irrespective

of the tenor.

7.0 REVIEWED TIMELINE

I recommend that this document should be reviewed bi-annually.