MANDATE DEACTIVATION SCENARIOS & PROCESSES

INTRODUCTION

This document strives to define and outline the scenarios that lead to customers being wrongfully debited due to the failure to properly deactivate mandates on their accounts. Mandates authorize RFS to automatically debit the customer’s account at regular intervals to ensure that their loan is repaid. When these mandates are not properly deactivated upon request or at the end of their validity, it can result in unauthorized debits, leading to customer dissatisfaction and potential financial liabilities for the organization. This document serves to detail the various scenarios under which these failures occur and to establish standardized procedures to prevent them.

SCOPE AND PURPOSE

This document applies to all departments and stakeholders involved in the management, monitoring, and deactivation of customer mandates. The focus is on ensuring that mandates are deactivated in a timely and accurate manner, thereby preventing unnecessary debits from customer accounts. The document covers:

• Scenarios that typically lead to the failure of mandate deactivation.

• Step-by-step processes for each scenario to prevent failures.

• Roles and responsibilities of different teams in ensuring mandates are properly handled.

OBJECTIVES

The objectives of this document are:

1. Identify Scenarios Leading to Unintended Debits: To clearly define the various scenarios where failure to deactivate mandates results in customers being wrongfully debited.

2. Establish Clear Processes: To provide step-by-step guidelines and best practices for handling mandate deactivations to ensure that no customer is debited in error due to the company’s oversight.

3. Enhance Customer Satisfaction: To minimize instances of unauthorized debits, leading to improved customer trust and satisfaction by ensuring proactive management of mandate deactivation.

4. Mitigate Financial Risks: To reduce the company’s exposure to financial liabilities caused by mishandled or delayed mandate deactivations.

SCENARIOS REQUIRING THE DEACTIVATION OF MANDATES

1. Bi-weekly termination of transactions.

2. Undisbursed loan/rejected offers.

3. Top-up disbursement.

PROCESSES FOR EACH SCENARIO

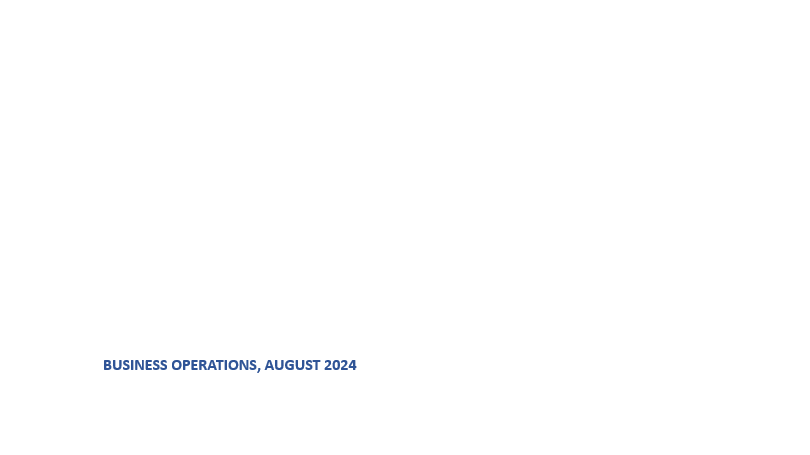

1. PROCESS FLOW FOR BI-WEEKLY TERMINATION OF TRANSACTIONS

Transactions that have spent 2 weeks or more at the booking and executed document upload stage are to be terminated and have their mandates deactivated. The process for this is found below.

PROCESS DETAILS

|

S/N |

Step |

Action |

Responsible Team |

|

1 |

Spool data |

The business operations team spools data from the ERP at the booking and executed document upload stages. This data contains the list of transactions that have remained these stages for at least 2 weeks. |

Business Operations |

|

2 |

Share data |

The data is sent to the sales team, copying collections, underwriting and the underwriting support teams. |

Business Operations |

|

3 |

Review data |

Sales team reviews and responds with the active transactions and reasons for pending transactions |

Sales |

|

4 |

Filter affected transactions |

Business operations team excludes active transactions from the list, leaving just the inactive ones. |

Business Operations |

|

5 |

Request mandate list |

Business Operations team requests for the list of Remita and NIBSS mandate created within the period in view for the affected items (from the underwriting team) |

Business Operations |

|

6 |

Share mandate list |

The underwriting team provides the list of requested mandates |

Underwriting |

|

7 |

Cross-check and collate |

Business operations team cross-checks mandates against the ERP-spooled transactions and sends the list of mandates to be deactivated to the Collections team. |

Business Operations |

|

8 |

Deactivate mandates |

After deactivating the mandates, the Collections team will send a confirmation reply on the email thread to confirm that the deactivation has been completed. |

Collections |

|

9 |

Share list |

Final list of transactions is sent to the underwriting support team for termination. |

Business Operations |

|

10 |

Terminate transactions |

Once the transactions have been terminated, the Underwriting Support team will reply on the email thread to confirm that the termination has been successfully executed. |

Underwriting Support |

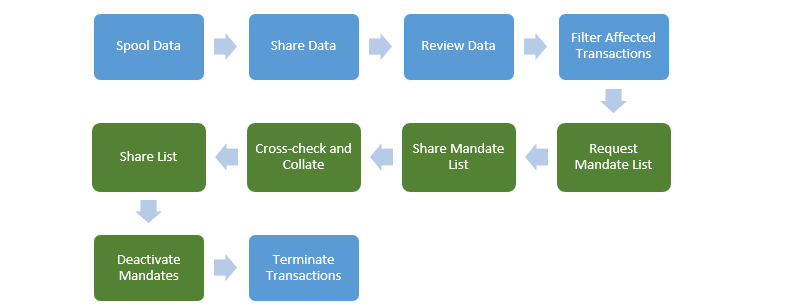

2. PROCESS FLOW FOR UNDISBURSED LOAN/REJECTED OFFERS.

Sales officer/account officers are expected to actively follow-up with their transactions at every stage of the loan process. Hence, in a situation where an offer is rejected by a customer, a customer loses interest or a loan is not disbursed, the sales officer is required to follow-up to ensure that the mandate on the customer’s account is deactivated, and the transaction is terminated. The process is highlighted below.

PROCESS DETAILS

|

S/N |

Step |

Action |

Responsible Team |

|

1 |

Share mandate and transaction details |

The account officer emails the transaction details and mandate to both the Underwriting Support and Collections teams. The Collections team will deactivate the mandate, while the Underwriting Support team will terminate the transaction. |

Sales |

|

2 |

Deactivate mandate |

After deactivating the mandate, the Collections team will send a confirmation reply on the email thread to confirm that the deactivation has been completed. |

Collections |

|

3 |

Terminate transaction |

Once the transaction has been terminated, the Underwriting Support team will reply on the email thread to confirm that the termination has been successfully executed. |

Underwriting Support |

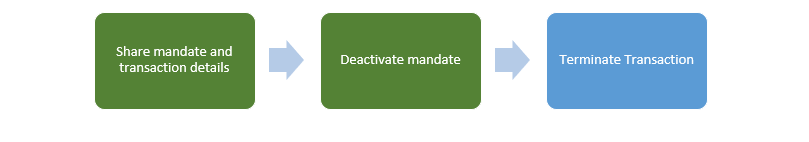

3. PROCESS FLOW FOR TOP-UP DISBURSEMENT

In certain situations, a customer may request a top-up to their loan. It is important that the mandate on the previous loan be deactivated to avoid double debits on the customer’s account during the repayment period. Finance team (disbursing officer) is responsible for notifying the collections team upon disbursement of the top-up transaction, so the active mandate(s) on the old account can be deactivated to avoid double debit. The process is highlighted below.

PROCESS DETAILS

|

S/N |

Step |

Action |

Responsible Team |

|

1 |

Disburse top-up amount |

The disbursing officer disburses the top-up amount. |

Finance |

|

1 |

Notify Collections |

The disbursing officer is responsible for sending the transaction details (including ID, customer name, amount, product type, etc.) to the Collections (Helpdesk) team. Upon receiving this notification, the Collections (Helpdesk) team will proceed to deactivate the active mandate(s) on the customer's old account. |

Finance |

|

2 |

Deactivate mandate |

After deactivating the mandate(s), the Collections team will send a confirmation reply on the email thread to confirm that the deactivation has been completed. |

Collections |

NOTE: The highlighted sections in green specifically emphasize the steps directly involved in the mandate deactivation. The other steps serve as supporting actions. All steps are crucial to the overall process.

CONCLUSION

This document provides a comprehensive overview of the process designed to prevent unauthorized customer debits by ensuring timely and accurate mandate deactivation. Adherence to these processes ensures better coordination between departments, maintains operational efficiency, and fosters trust with our customers. Continuous monitoring and improvement of these processes will further enhance our ability to effectively manage mandates and avoid unintended debits.

VERSION HISTORY

|

Version |

Revision Date |

Description of Change |

Author |

Stakeholders’ Concurrence |

|

1.0 |

12/09/24 |

First draft |

Obiageli Mbah |

Emmanuel Onakoya Chima Agu Isimemen Ebhomien Raphael Brayila Adetayo Olukoga |

|

|

|

|

|

|

|

|

|

|

|

|

No Comments